The Importance Of Personalized Investment Planning: Tailored Growth

Personalized investment planning is crucial for aligning financial goals with individual risk tolerance and life circumstances. It ensures investments are tailored to specific needs, enhancing potential returns and satisfaction.

Embarking on an investment journey without a personalized plan is like navigating uncharted waters without a map. Each investor’s financial landscape is unique, and a one-size-fits-all approach must often be revised. A well-rounded introduction to the importance of personalized investment planning must highlight its role in efficiently managing assets, minimizing unnecessary risks, and paving the way towards achieving financial milestones.

Personalized strategies consider diverse elements such as age, income, financial objectives, and market conditions, fostering a sense of security and control over one’s financial future. Crafting a bespoke investment plan is not just about wealth accumulation; it’s about constructing a financial blueprint that resonates with individual goals, providing clarity and confidence in one’s financial decisions.

Personalized Investment Journey

Personalized investment planning tailors strategies to individual financial goals. Generic advice often needs to include unique circumstances. Diverse financial backgrounds and goals demand customized investment portfolios. Personal risk tolerance, timelines, and income levels influence investment choices. Designing a personal investment plan ensures alignment with specific life stages and financial targets.

| Parameter | Generic Plan | Personalized Plan |

| Risk Tolerance | Assumed average | Adjusted to comfort level |

| Income Levels | Not considered | Tailored strategies |

| Financial Goals | Generic targets | Specific objectives |

| Life Stages | One-size-fits-all | Life-centric planning |

Investors deserve strategies that reflect their life’s journey. Each individual’s financial roadmap is unique. Embracing customized investing can lead to better satisfaction and success. Trust in a plan that speaks to personal narratives.

Goals And Risk Tolerance

Identifying your financial objectives is a crucial step. Think about what you want to achieve. Your goals might be buying a home, paying for education, or building wealth for retirement. It’s essential to set clear, achievable targets for your financial journey.

Assessing your risk appetite involves understanding your comfort level with market fluctuations. Some investors sleep well with high-risk investments, eyeing more significant returns. Others prefer stable, low-risk options for peace of mind. Your risk tolerance will shape your investment strategy. Finding a balance that suits your life stage and goals is vital.

Tailored Strategies For Diverse Investors

Personalized investment planning is crucial across generations. Millennials often seek growth-focused strategies. They are tech-savvy and comfortable with online platforms, and their plans might include stocks and cryptocurrencies.

Baby Boomers, on the other hand, prioritize retirement security. They may choose bonds, annuities, or dividend-yielding stocks, which can provide steady income.

Different income levels require unique approaches. Individuals with higher incomes may explore tax-efficient investments. Those with moderate incomes might benefit from a mix of savings and growth-oriented investments.

The Role Of Technology

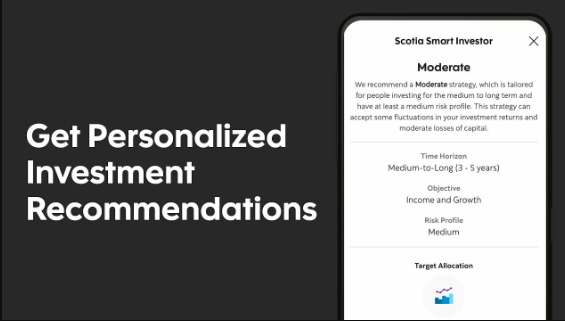

Technology plays a crucial role in modern investment strategies. Robo-advisors are now a key element in offering tailored financial guidance. These automated platforms utilize advanced algorithms to analyze personal financial data. This leads to highly personalized investment plans.

The integration of Artificial Intelligence (AI) significantly enhances portfolio management. AI can process vast amounts of market information rapidly, ensuring that investment strategies are responsive to market changes. Clients receive customized advice that aligns with their unique goals. Such tools empower investors to make well-informed decisions. The technology-driven approach to investment planning marks a new era in personal finance.

Benefits Of Personalized Portfolios

Personalized portfolios are tailored to meet your unique financial goals. These custom investment plans can enhance performance potential. They consider your risk tolerance and investment horizon, helping you achieve optimal returns.

Personalization also offers emotional comfort. With investments aligned with your values, stress is reduced. You gain peace of mind, knowing your portfolio reflects your financial situation. This adds to investment peace, even when markets fluctuate.

Challenges And Considerations

Managing data privacy and security is a critical challenge in personalized investment planning. Investors worry about their personal information. They want to keep it safe. Experts must use strong protection measures to build trust. The right tools and strategies are essential for keeping data secure.

Customizing plans can cost money. Different people need different plans, and some may need more complex help, which means higher costs. Yet, good planning can lead to better investment success. The investment might be worth it. Remember to weigh the costs against potential benefits.

The Financial Advisor’s Perspective

Personalized investment planning is critical for building trust with clients. A financial advisor understands that each client has unique goals. Customized strategies are crucial to meet specific financial needs. This approach shows clients that their advisor is genuinely invested in their success. Trust grows when clients see their portfolio reflects personal risk tolerance and life milestones.

Advisors who leverage personalization stand out in a competitive market. They show their commitment to client outcomes, not just generic advice. Creating a tailored plan is not just about the numbers; it’s about understanding the person behind the investments. A deep client relationship leads to client retention and referrals.

Personalized investment strategies may include:

- Diverse investment options that align with the client’s interests

- Tailored risk assessments, ensuring comfort with investments

- Regular portfolio reviews for ongoing alignment with client goals

Future Of Investment Planning

The investment landscape constantly evolves, demanding personalized strategies. Investors now must navigate volatile markets, shifting economic indicators, and rapid technological advancements. Adapting to these changes is critical for long-term financial health.

Sustainability and social responsibility also shape investment planning. People want their money to support ethical practices, so they choose companies that care for the environment and society. This shift leads to the growth of green investments.

Conclusion

Crafting a tailored investment strategy stands paramount in securing your financial future. It ensures your portfolio aligns with your unique goals, risk tolerance, and timeline. Embrace personalized investment planning; let it guide your aspirations of financial stability and growth.